Send trust receipt agreement sample via email, link, or fax. You can also download it, export it or print it out.

With DocHub, making changes to your paperwork requires only a few simple clicks. Follow these quick steps to change the PDF Sample trust receipt online free of charge:

Our editor is very intuitive and effective. Try it out now!

Fill out sample trust receipt onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

What is an example of trust receipt?Example of a Trust Receipt The business keeps any profits made from the resale of the goods but also bears the business risk. If the goods get damaged, lost, or deteriorate in quality or value, the loss is solely the burden of the business and it remains liable for repaying the full loan amount to the bank.

What is the purpose of a trust receipt?Trust receipts are used under letters of credit or collections so that the buyer may receive the goods before paying the issuing bank or collecting bank. See documentary collection; letter of credit.

What is finance against trust receipt?The bank provides short-term financing in the form of Trust Receipt (T/R), advance payment for goods and services on behalf of buyer or importer will be made by the bank. The buyer or importer will pay the bank on maturity date ing to the T/R term.

What is the process of a trust receipt?Trust Receipts is a common financing provided by the bank to the importer. The customer was granted with a revolving trust receipts facility after its credit standing, financial profile is assessed by the bank. Trust receipt limit has a fixed tenor and usually used together with import letter of credit limit.

What is LC and LTR?The main objectives of the paper are to analyze the extent of loan against trust receipts ( LTR ) facility given by the commercial banks to their clients (importers/exporters/entrepreneurs) against Letter of Credit (L/C) and to identify the malpractices of LTR facility.

receipt and release form to beneficiaries pennsylvania receipt and release form to beneficiaries new york real estate trust account receipt template trust release form

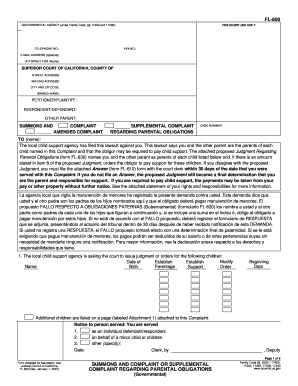

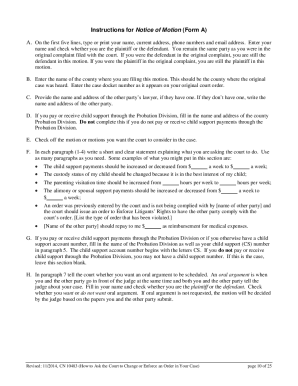

FL-600 GOVERNMENTAL AGENCY under Family Code 17400 and 17406 TELEPHONE NO. FOR COURT USE ONLY To keep other people fro .

m. or as soon after that as the matter may be heard defendant will apply to whichever judge is hearing matters in the Su .

A trust receipt is a financial document attended to by a bank and a business that has received delivery of goods but cannot pay for the purchase until after the inventory is sold. In most cases, the companys cash flow and working capital may be tied up in other projects and business operations.

What is the difference between a letter of credit and a trust receipt?A Letter of Credit assures the sellers of payment when issues an LC ing to stipulated terms while a Trust Receipt Loan a form of financing for the buyers whereby the bank makes an advance to the buyers to settle an import bill.

What are the elements of trust receipt?A trust receipt need not be in any particular form, but every such receipt must substantially contain (a) a description of the goods, documents or instruments subject of the trust receipt; (2) the total invoice value of the goods and the amount of the draft to be paid by the entrustee; (3) an undertaking or a

What are the characteristics of trust receipt?General Features TR is strictly for financing of working capital requirement and must not be used to finance purchase of fixed assets e.g.plant, machinery, etc. The minimum period of financing is 7 days and the maximum period must not exceed the approved financing tenure by the bank.

What is the purpose of a trust receipt?Trust receipts are primarily used for tangible goods, such as inventory, equipment, or commodities with a physical presence. They involve a borrower holding the goods on behalf of a lender until the loan associated with the goods is repaid.

The trustee's duties include receipt and management of the trust assets, collection of income, accounting, tax reporting and payments, investment and income .